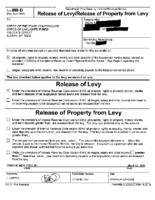

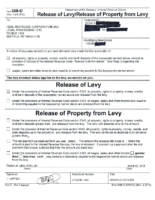

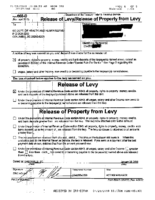

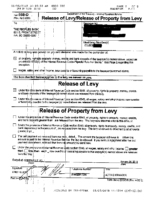

ACTUAL AGREEMENTS

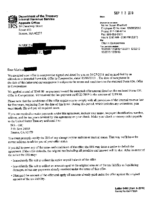

Department of Treasury Internal Revenue Service

Offer in Compromise

(James) <——— Put your name right here!

We have accepted your offer in compromise signed and dated by you on (DATE). The date of acceptance is the date of this letter.

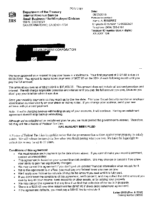

Pay When Able

(Martin) <——— If you’re retired on SS, you probably won’t ever pay!

We have noted your account that you’re currently unable to pay your total balance or to make installment payments. You may make payments as you are able.

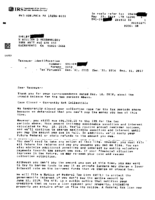

Installment Agreement

(Ian) <——— Well within his budget!

We’ve accepted your offer for an Installment Agreement. The agreement covers the tax period(s) shown above. Please make your first payment of $50.00.

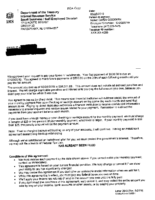

Innocent Spouse

(Marian) <——— Innocent spouse, over $25,000 taxes forgiven!

You are also entitled to equitable relief of liability under Section 6015(f) of the Internal Revenue Code of the tax that was not paid with the filed tax return(s).

Decreased Lien

(Robert) <——— Saved him over $200,000!

Updated the amount of the Notice of Federal Tax Lien, from $215,881.92 to the decreased amount…of $11,491.93.