You received a notice of “Intent to Levy” 30 days ago and you forgot about it or ignored it. Now the levy date is here, and you do not know what to do or where to go? Expecting a paycheck, you may open the envelope or check your direct-deposit balance online only to find that the IRS has taken nearly all of your money. No matter how much you plead with an employer, they cannot give you your money. Because a wage garnishment is filed with your employer, your employer is bound by law to send a large percentage of your paycheck to the government instead of you.

Tax Problems Are More Urgent Than You Think

Your wage garnishment matters may be much more urgent than you originally think. The IRS can place a levy on your income that will garnish your wages on a continuous basis. This means that a wage garnishment from the IRS will not only take money from your current paycheck, but will also apply to future paychecks. Money will continuously be taken from your pay until your taxes are satisfied or until the levy is lifted.

Additionally, when you owe money, you could experience both creditors and IRS officers trying to collect from you. While state and federal laws govern how much creditors can take from your paycheck, tax laws only govern how much the IRS can leave in your paycheck. When the IRS can take as much as they want and leave you with the minimal amount of money as determined by tax laws, you could find yourself in serious financial trouble, especially when you can no longer pay credit card bills, your mortgage, and daily expenses like food or transportation.

At my office, I am regularly retained by taxpayers to negotiate the release of wage garnishments orders from the IRS. I strive to represent my clients to the fullest extent, which helps attain the most favorable settlement for my clients. Negotiating a deal can be far more in your interests! As a former IRS Revenue Agent, I know that negotiating with the IRS for a collection alternative could let you receive your whole paycheck without the fear of future wage garnishment.

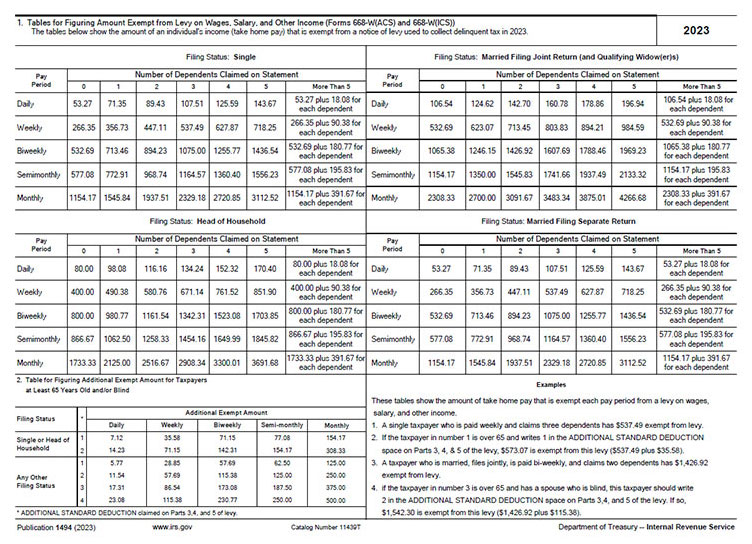

IRS Publication 1494

Tables for Figuring Amount Exempt from Levy on Wages, Salary, and Other Income.

Take Action Now. Guaranteed IRS Wage Garnishment Release Help Is Here!

Reach out for help with your IRS wage levy problem by contacting me today. Telephone calls are always answered immediately and emails are returned the same day. If you have questions about your IRS wage garnishment I provide free case evaluations for my callers.

Getting together with you over the phone or in person is a way for me to get to know your situation better and establish which plan of action can result in the best possible solution. When you are ready to discuss your wage garnishment tax problems, call my office to speak with me. I am glad to help, so call my office today!

Lowest Price and Best Results Guarantee